VC Secondaries Explained: Navigating Liquidity in Private Markets

Venture capital (VC) has long been synonymous with high-risk investments, long holding periods, and the promise of lucrative returns. But with those rewards often come challenges – chief among them, the lack of liquidity. Investors have historically had to wait years, often a decade or more, for a portfolio company to exit via IPO or M&A before seeing any returns. In the 2000s, the median age of European tech IPOs was around 9 years. By 2022, that number had increased to 15 years – and it continues to rise1. As the venture ecosystem matures and companies stay private longer, the VC secondaries market is gaining significant traction. This raises an important question: what exactly are VC secondaries and what are the different structures?

What are VC Secondaries?

VC secondaries involve buying and selling existing stakes in privately held companies and funds from current shareholders or limited partners. Unlike primary investments, which inject new capital in exchange for equity, secondaries transfer ownership between investors. These transactions typically take three different structures.

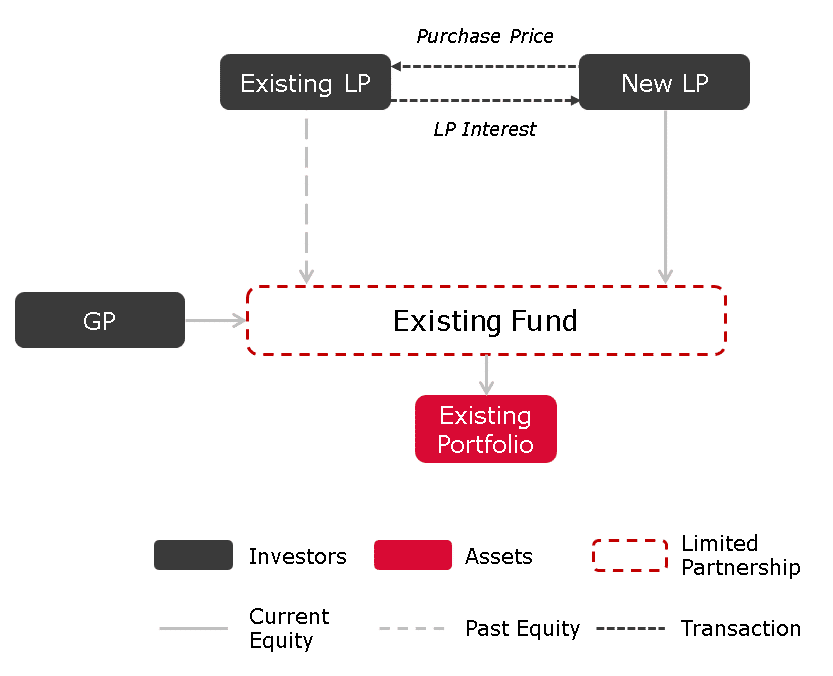

1) LP-Led Secondaries

LP-led secondaries occur when an existing LP in a fund sells their stake to a secondary buyer, who then becomes an LP. These transactions are typically bilateral, meaning the fund structure remains unchanged, and the purchasing LP simply takes over the selling LP’s position in the fund, including any undrawn commitments.

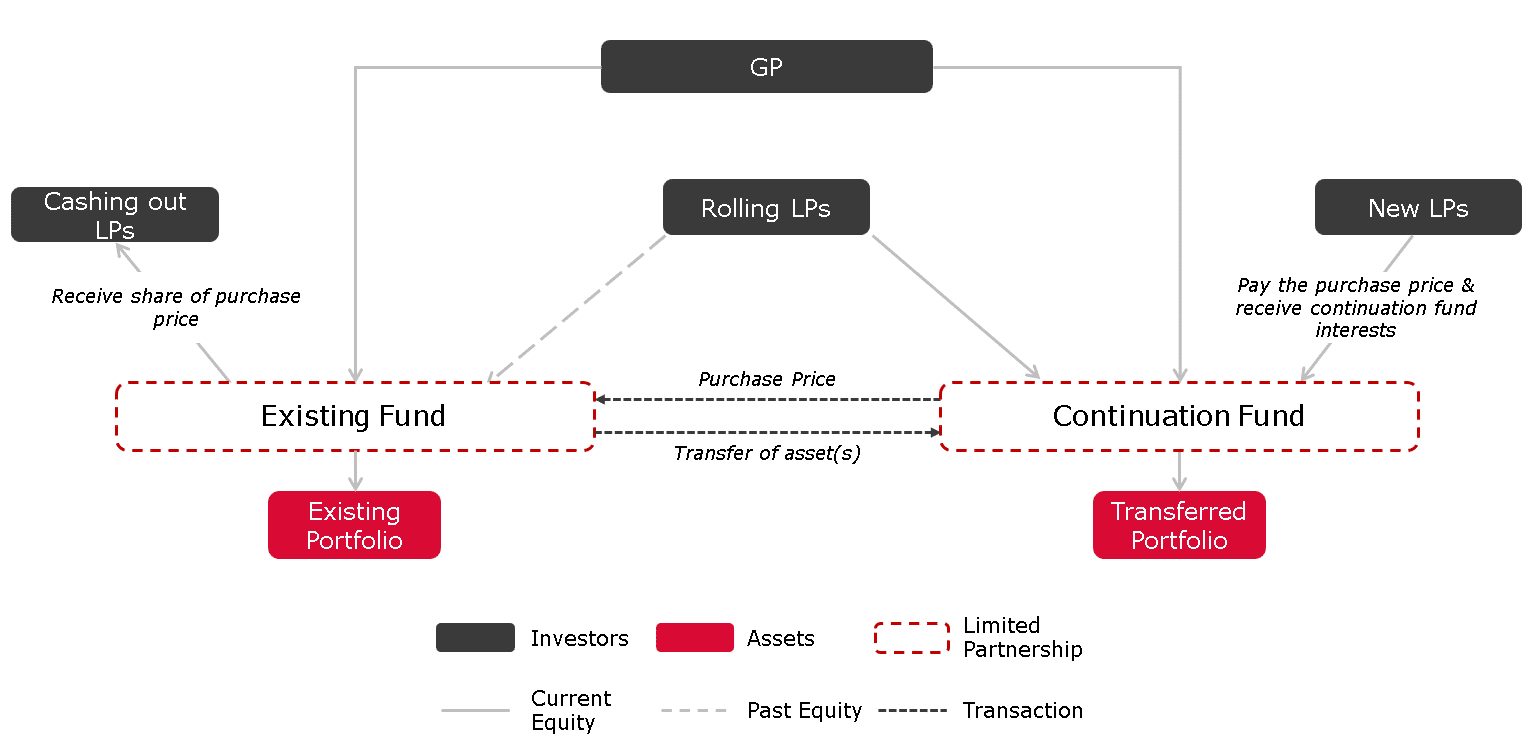

2) GP-Led Continuation Vehicle

A GP-led Continuation Vehicle allows a General Partner (GP) to transfer portfolio assets – or a single asset – into a new fund, enabling continued management. Existing LPs have three options: cash out their investment, roll over their interest into the continuation fund, or do both in some cases. LPs can roll over on either a reset basis, where they participate under new economic terms, the GP crystallises carried interest (if any), and new carried interest and management fees apply – most times with additional GP capital commitments required – or a status quo basis, where they retain substantially the same terms, the GP typically does not crystallise carried interest (if any) with any earned but unrealised carry rolling over into the continuation fund.

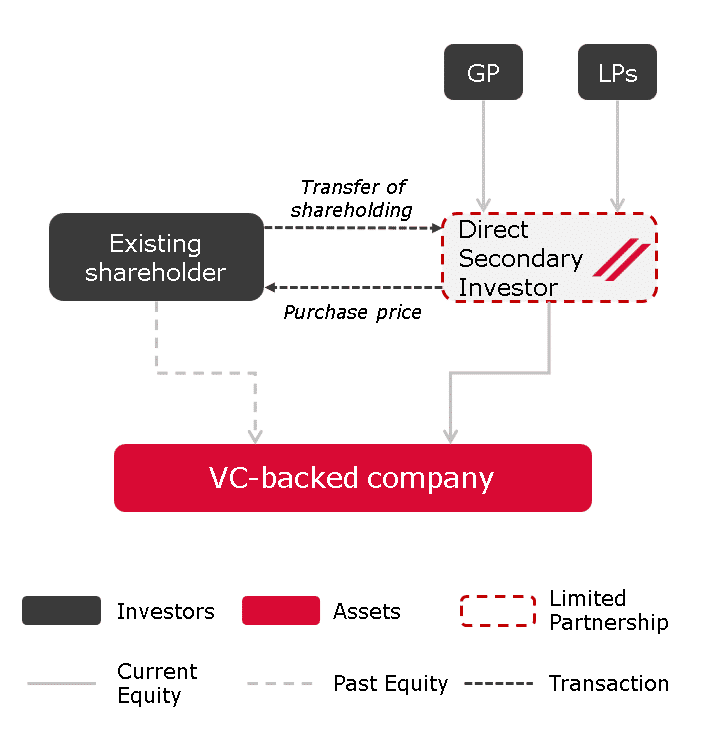

3) Direct Secondaries – called ‘direct’ since it involves a change of ownership directly in an investor’s underlying companies

Single Asset Direct Secondaries

Single Asset Direct Secondaries occur when an existing shareholder – such as a VC fund, CVC (Corporate VC), angel investor, founder(s) or management/employees – sells their stake (or part of it) in a privately held company to a direct secondary investor. This provides liquidity to the seller, often allowing i) the original fund to return capital to its LPs (boosting DPI) and refocus on other portfolio companies, or ii) the former founders to crystallise capital for new ventures, or iii) management/employees to crystallise capital gain ahead of a full exit.

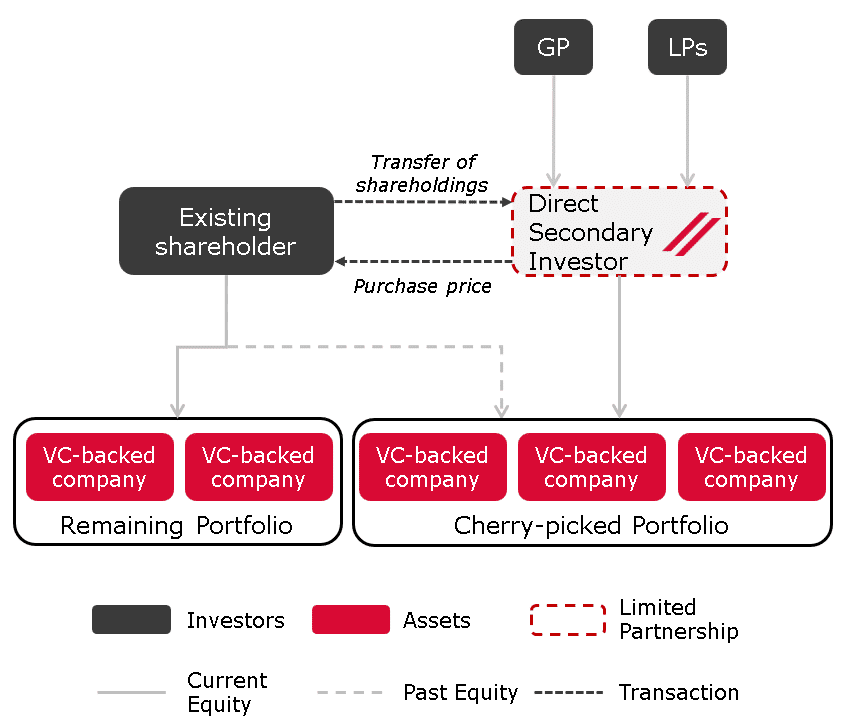

Portfolio Direct Secondaries

Portfolio Direct Secondaries occur when a VC, Corporate VC (CVC), family office or hedge fund – sells stakes in multiple privately held companies to a secondary investor in a single transaction. The secondary buyer can either selectively acquire the most promising assets (i.e. the minority interests) from such portfolios leaving the remainder of the portfolio behind or acquire all the assets (i.e. all the minority interests) in the portfolio.

In both circumstances, the secondary buyer would expect to acquire the class of shares (e.g., common or preferred) that the seller holds, along with any associated rights (e.g., liquidation preference, anti-dilution protection) and obligations (e.g., right of first refusal, drag-along rights). However, these rights and terms might be restructured in some cases.

Some transactions also involve the buyer acquiring just a portion of the seller’s stake in each company. This is called a “strip” transaction.

TempoCap specialises in Direct Secondaries, acquiring both single company stakes and curated portfolios from existing investors. This strategy offers access to category leaders at attractive valuations, with discounted secondary pricing creating a compelling risk-return profile. Our single company strategy gives us visibility on the best technology assets for either single company investments or cherry-picking these assets in a portfolio transaction. This strategy also allows us to generate accelerated DPI with our 2020 fund having already generated a 0.9x DPI after 4 years. If you are interested to learn more about our strategy, please let us know at Jack@tempocap.com.

Source:

- Lazard, J. Ritter (2024) University of Florida.